The logistics landscape in Georgia is more competitive than ever in 2026. For owner-operators and fleet managers, the most frequent question is: how much does trucking insurance cost? The answer isn't a single number but a strategic calculation based on your equipment whether it's a semi tractor, a commercial pickup, or a specialized hot shot trucking rig.

The Real Cost of Trucking Insurance in 2026

Across the United States and specifically in Georgia, insurance premiums have seen a steady adjustment. For a standard owner-operator, the total trucking insurance cost typically ranges from $9,000 to $16,500 per year. However, for those operating under a New Authority, these figures can easily cross the $18,000 mark.

Why does single truck insurance vary so much?

If you are looking for single truck insurance, your premium is a reflection of your risk profile. A driver hauling a semi tractor and trailer across state lines faces higher risks (and higher premiums) than a local delivery van. In Georgia, the high-traffic corridors of Atlanta and the heavy freight moving through Savannah play a massive role in these calculations.

Breaking Down the Coverage Types

To understand how much does trucking insurance cost, you have to look at the individual ingredients of your policy.

Trucking Liability Insurance Cost

This is the most expensive and most important part of your policy. It covers bodily injury and property damage to others if you are at fault in an accident. In Georgia, while the federal minimum might be $750,000, almost every broker requires $1,000,000 in Primary Liability.

Get More information about that:

https://www.fmcsa.dot.gov/registration/insurance-filing-requirements

Non-Trucking Liability Insurance Cost (NTL)

Non-trucking liability insurance cost is a common concern for drivers leased to a motor carrier. This covers you when you are using your truck for non-business purposes (off the clock). Typically, NTL is much more affordable, costing between $400 and $600 per year.

Hotshot Trucking Insurance Cost

A booming sector in Georgia is Hotshotting using a commercial pickup insurance policy to haul smaller, time-sensitive loads. Many ask: how much does insurance cost for hot shot trucking? Because hotshot rigs are smaller than Class 8 semis, the insurance is slightly different, but the liability requirements are the same. Expect your hot shot trucking insurance cost to land between $7,000 and $12,000, depending on your cargo and equipment.

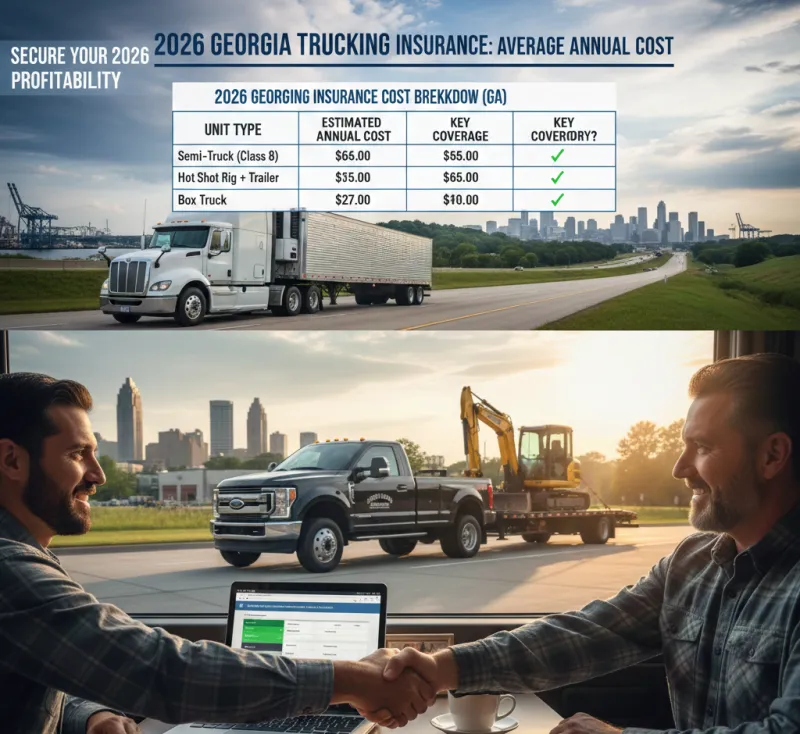

Average Trucking Insurance Cost in 2026 (State Comparison)

In 2026, Georgia ranks among the top states for trucking activity, which also reflects in the premiums. On average, a Georgia-based operator pays between $14,000 and $21,000 per year for a full coverage package.

Unit Type | Estimated Annual Cost (GA) | Key Coverage Included |

|---|---|---|

Semi-Truck (Class 8) | $12,000 - $18,500 | $1M Liability + PD + Cargo |

Hot Shot Rig (Pickup + Trailer) | $7,500 - $12,000 | $1M Liability + Cargo |

Box Truck | $4,500 - $9,500 | $1M Liability + PD |

Hazmat Tanker | $22,000 - $35,000 | $5M Liability + Specialized Cargo |

Semi Tractor vs. Commercial Pickup Insurance

The type of iron you drive dictates your rate.

Semi Tractor Insurance: This is the heavyweight of the industry. Because of the weight and potential for damage, premiums are higher.

Commercial Pickup Insurance: Often used for hotshotting or local contracting. While the vehicle is smaller, if it’s used for business, a standard auto insurance policy won't cover you you need a commercial-grade policy.

Commercial Truck and Trailer Insurance: Combining both into one policy is often cheaper than insuring them separately.

If you are managing multiple business assets you might also find our guide on 2026 HVAC Installation Cost Guide: Dallas, TX helpful for understanding service-based business overheads.

Factors That Drive Insurance Quotes in Georgia

When you request insurance quotes, underwriters look at The Big Three :

Driver Experience: If you have less than two years of CDL experience, expect your trucking liability insurance cost to be at its peak.

The Route Radius: Georgia drivers staying within a 100-mile radius (Intrastate) pay less than those hauling to California or New York (Interstate).

Credit History: In the commercial world, your business credit score is a major factor in determining your trucking insurance cost.

Commercial Truck Fleet Insurance

As your business grows from one truck to five, you move from single truck insurance to commercial truck fleet insurance. Fleet policies often offer a per-power-unit discount. In Georgia’s logistics-heavy economy, managing a fleet requires constant monitoring of your CSA scores to keep these premiums low.

How Much Does Insurance Cost for Hot Shot Trucking?

We get this question daily. To be specific, a hotshot driver with a 40-foot flatbed trailer hauling for a major broker will need:

$1 Million Liability

$100,000 Cargo

Physical Damage based on truck value.

The hotshot trucking insurance cost in Atlanta or Savannah is currently averaging $850 - $1,100 per month.

Maximizing Value: Beyond Just Auto Insurance

While auto insurance is a term people use for their cars, in the trucking world, we talk about business protection. You are a business owner, not just a driver. To lower your costs:

Increase Deductibles: If you can afford to pay $2,500 out of pocket for a claim instead of $1,000, your annual premium will drop by 15%.

Safety Tech: AI dash-cams are the biggest trend of 2026. Insurers love them.

Clean MVR: One speeding ticket in your personal car can raise your semi tractor insurance by $1,000 next year.

Factors Influencing Trucking Insurance Quotes

Underwriters in 2026 use AI to scan your data. Here is what impacts your trucking insurance cost:

Factor | Impact on Premium | How to Improve |

|---|---|---|

CDL Experience | High (Up to 40% swing) | Hire drivers with 2+ years of clean MVR. |

Operating Radius | Medium | Limit your radius to 500 miles if possible. |

Cargo Type | High | Avoid Hazmat or high-value autos for lower rates. |

Equipment Age | Low to Medium | Newer trucks have higher "Physical Damage" costs but better liability rates. |

Managing a business in Georgia involves various moving parts. For instance, if your business also owns property, you should be aware of regional risks. Read our guide on 5 Warning Signs of Sinkhole Damage in Florida to see how environmental factors impact business insurance.

Furthermore, if you are looking into tech-based logistics, our article on AI-Powered Smart Homes 2026 shows how AI is changing the way we live and work.

Conclusion: Securing the Best Insurance Quotes

In 2026, the key to finding the best trucking insurance cost is not just searching for the cheapest policy but the most reliable one. Whether you operate a semi tractor, a commercial truck and trailer, or a hot shot rig, Georgia offers a robust market of providers.

Before signing your next policy, ensure you have compared at least three insurance quotes and checked the A-Rating of the provider to ensure they can pay out in case of a major claim.

Frequently Asked Questions (FAQs)

Q: How much does trucking insurance cost for a brand-new authority? .

A: New authorities in Georgia usually face premiums between $16,000 and $22,000 per year for their first year.

Q: What is the difference between bobtail and non-trucking liability?

A: Bobtail covers the truck when the trailer is detached. Non-trucking liability covers the truck when it's used for personal reasons.

Q: Why is semi tractor insurance more expensive than commercial pickup insurance?

A: Due to the weight (80,000 lbs vs 15,000 lbs), the damage potential of a semi is significantly higher, leading to higher liability risks.