East Meadow New York 11554 remains one of Nassau County most sought-after residential communities. Bordered by the sprawling green expanses of Eisenhower Park Long Island's largest public park and a beloved community gathering space this hamlet offers the perfect blend of suburban tranquility and metropolitan accessibility. As we move through 2026, the East Meadow real estate market continues to present both opportunities and challenges for prospective homeowners.

This guide will walk you through every available resource, from substantial grant programs offering up to $50,000 in down payment assistance to low-interest mortgage products designed specifically for first-time buyers. Whether you are exploring buyer home inspection services, seeking the Property , or need to sell my house fast before purchasing your dream home, this comprehensive resource will provide the roadmap you need.

Section 1: Financial Assistance Programs The Goldmine for East Meadow Buyers

Long Island Housing Partnership (LIHP) Programs

The Long Island Housing Partnership (LIHP) stands as one of the most valuable resources for first-time home buyers in Nassau County. Established as a nonprofit organization dedicated to creating affordable homeownership opportunities, LIHP offers grant programs that can provide $30,000 or more in down payment and closing cost assistance.

LIHP Grant Highlights:

Grant amounts typically range from $30,000 to $40,000

Funds can be used for down payment and closing costs

No repayment required if you remain in the home for a specified period (usually 10 years)

Income limits apply based on household size and Area Median Income (AMI)

Homebuyer education courses required (8-12 hours)

The LIHP program is particularly attractive because it offers forgivable loans that essentially become grants. If you maintain the property as your primary residence and don't sell or refinance during the forgiveness period, the entire amount is forgiven. This represents thousands of dollars that would otherwise come out of your pocket.

To access LIHP programs, you must complete a HUD-approved homebuyer education course and work with approved lenders. Visit the Long Island Housing Partnership at for current program details and application requirements. The application process requires documentation of income, assets, and credit history, but the potential rewards make this effort worthwhile.

SONYMA Achieving the Dream Program

The State of New York Mortgage Agency (SONYMA) Achieving the Dream program offers another powerful tool for East Meadow first-time buyers. This program provides low-interest mortgage financing combined with down payment assistance.

SONYMA Program Benefits:

Interest rates typically 0.5% to 1% below conventional market rates

Down payment assistance up to $15,000 (repayable as a second mortgage)

Available for purchase prices up to $456,750 in Nassau County

Minimum credit score requirement of 620

First-time buyer definition: hasn't owned a home in the past three years

The interest rate savings with SONYMA can translate to hundreds of dollars in monthly savings over the life of your loan. On a $400,000 mortgage, a 1% interest rate reduction could save you approximately $240 per month or nearly $87,000 over a 30-year term.

Nassau County HOME Down Payment Assistance Program

Perhaps the most generous program available to East Meadow buyers is the Nassau County HOME Down Payment Assistance Program, which can provide up to $50,000 in down payment and closing cost assistance.

Program Features:

Grant amounts up to $50,000 for eligible households

Deferred payment loan structure with 0% interest

Forgiven after maintaining residence for 15 years

Income limits: typically 80% of Area Median Income or below

Must purchase within Nassau County boundaries

This program represents a game changing opportunity for families who might otherwise struggle to accumulate sufficient down payment funds. A $50,000 grant on a $500,000 home effectively provides a 10% down payment, potentially eliminating the need for private mortgage insurance (PMI) and significantly reducing monthly payments.

Applications for the Nassau County HOME program are processed through approved housing counseling agencies. Given the program's popularity and limited annual funding, early application is essential. Working with knowledgeable local lenders like Jet Direct Mortgage, who understand these specialized programs, can streamline the process significantly.

Section 2: Mortgage Services and Loan Products for East Meadow Buyers

FHA Loans: The First-Time Buyer Standard

Federal Housing Administration (FHA) loans remain the most popular choice for first-time home buyers nationwide, and East Meadow is no exception. These government-insured loans offer several advantages that make homeownership more accessible.

FHA Loan Advantages:

Minimum down payment of just 3.5% for borrowers with credit scores of 580+

More lenient credit requirements than conventional loans

Debt-to-income ratios up to 43% (sometimes higher with compensating factors)

Gift funds allowed for down payment and closing costs

Assumable by future buyers

For an East Meadow home priced at $600,000, an FHA loan would require just $21,000 down (3.5%), compared to $60,000 or more for a conventional 10% down payment mortgage. This dramatic difference can accelerate your path to homeownership by years.

The trade-off with FHA loans involves mortgage insurance. Borrowers pay an upfront mortgage insurance premium (UFMIP) of 1.75% of the loan amount, plus annual mortgage insurance premiums (MIP) that range from 0.45% to 1.05% depending on loan amount and down payment. For many first-time buyers, however, this cost is worthwhile given the reduced down payment requirement.

Fannie Mae 97% LTV Programs

Fannie Mae's conventional loan programs offer another attractive option for qualified East Meadow buyers. The HomeReady and standard 97% loan-to-value (LTV) programs allow down payments as low as 3%.

Fannie Mae 97% Program Benefits:

Just 3% down payment required

Conventional loan (not government-insured)

PMI can be removed once you reach 20% equity

No income limits on standard 97% program

Flexible income sources accepted (HomeReady)

The HomeReady program specifically targets low-to-moderate income buyers and offers additional flexibility, including the ability to count boarder income and income from non-borrower household members. This can be particularly helpful for multi-generational households common in East Meadow's diverse community.

Local Lenders: The Jet Direct Mortgage Advantage

Working with local lenders who specialize in the East Meadow and Nassau County market provides distinct advantages. Jet Direct Mortgage and similar regional lenders offer:

Deep knowledge of local first-time home buyer programs

Established relationships with LIHP and county assistance programs

Understanding of East Meadow's specific neighborhoods and property values

Faster processing times for local transactions

Personalized service throughout the homebuying journey

Local lenders can often package multiple assistance programs together, maximizing your buying power. For example, combining a SONYMA loan with LIHP down payment assistance and the Nassau County HOME program could provide comprehensive financing with minimal out-of-pocket costs.

Section 3: Buyer Home Inspection Services Protecting Your Investment

The Critical Importance of Professional Inspections

East Meadow's housing stock includes many homes built between the 1950s and 1970s, during Long Island's post-war suburban expansion. While these homes often feature solid construction and generous lot sizes, they also come with age-related issues that require careful inspection.

Professional buyer home inspection services are not optional they're essential. A thorough inspection by a qualified professional can identify:

Structural issues (foundation cracks, settling, water damage)

Roof condition and remaining lifespan

Electrical system safety and capacity

Plumbing system integrity (especially important in older homes)

HVAC system functionality and efficiency

Potential environmental hazards (lead paint, asbestos, radon)

The cost of a comprehensive home inspection in East Meadow typically ranges from $450 to $700 depending on home size and additional specialized testing. This investment can save you tens of thousands of dollars by identifying problems before you commit to purchase.

East Meadow Home Inspection Checklist

Inspection Category | Key Points to Verify | Estimated Cost if Repairs Needed |

|---|---|---|

Foundation & Structure | Cracks, settling, water intrusion | $3,000 - $25,000+ |

Roof System | Shingle condition, flashing, ventilation | $8,000 - $20,000 |

Electrical System | Panel capacity, wiring condition, GFCI outlets | $2,000 - $15,000 |

Plumbing System | Pipe material, water pressure, drain function | $1,500 - $10,000 |

HVAC System | Heating/cooling function, age, efficiency | $5,000 - $15,000 |

Windows & Doors | Seals, operation, energy efficiency | $500 - $8,000 |

Insulation & Ventilation | Attic insulation, vapor barriers, ventilation | $1,500 - $6,000 |

Understanding these potential costs helps you budget appropriately and negotiate repairs or price adjustments with sellers. For detailed guidance on working with contractors for post-purchase repairs, see our guide on how to choose a reliable home contractor in the USA.

Specialized Inspections for East Meadow Properties

Beyond the standard inspection, East Meadow buyers should consider several specialized assessments:

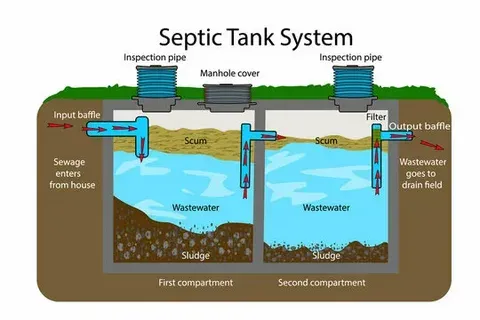

Sewer Scope Inspection: Many East Meadow homes have older cast iron or clay sewer lines that may have deteriorated or been invaded by tree roots. A sewer scope inspection ($200-$400) uses a camera to inspect the condition of your sewer line from the house to the street connection.

Radon Testing: Long Island has areas with elevated radon levels. A radon test ($150-$300) determines if your potential home has dangerous radon concentrations requiring mitigation.

Termite and Pest Inspection: Wood-destroying insects can cause extensive damage. A pest inspection ($100-$200) identifies active infestations or previous damage.

These specialized inspections provide comprehensive protection for your investment. When budgeting for your home purchase, factor in these costs along with your down payment and closing costs. Our average home repair costs across America in 2025 article can help you develop realistic maintenance budgets.

Section 4: Alternative Options Cash Home Buyers and Quick Sales

When You Need to Sell Before You Buy

Many East Meadow buyers find themselves in a challenging position they want to purchase a new home but first need to sell their current property. In a competitive market having your purchase contingent on selling your existing home can put you at a significant disadvantage.

This is where best cash home buyer services near me become valuable. Cash home buying companies offer:

Quick closing timelines (often 7-14 days)

No repairs or renovations required

No real estate commissions

Certainty of sale (no financing contingencies)

The trade off is typically a lower sale price usually 70-85% of fair market value. However, for buyers who need to sell my house fast to free up equity for a new purchase, this option provides valuable flexibility.

Evaluating Cash Buyer Services

When considering cash buyer services in the East Meadow area, evaluate:

Reputation and Longevity: Look for established companies with verifiable track records and positive reviews from local homeowners.

Transparent Pricing: Legitimate cash buyers should clearly explain how they calculate offers and any fees involved.

Professional Process: Reputable companies use standard purchase contracts and work with licensed real estate attorneys.

No Obligation Offers: You should be able to receive an offer without any commitment or pressure to accept.

Cash buyer services work best for specific situations: inherited properties requiring extensive updates, homes with significant deferred maintenance, or when timing is critical for your next purchase. For properties in good condition in desirable East Meadow locations, traditional sales through real estate agents typically yield higher net proceeds despite commission costs and longer timelines.

Bridge Loans and Contingent Offers

For buyers who don't want to accept below-market cash offers, bridge loans offer another solution. These short-term loans provide funds based on your current home's equity, allowing you to make non-contingent offers on your new East Meadow home. Once your existing home sells, the bridge loan is repaid.

Bridge loans typically feature:

Interest rates 2-3% above conventional mortgages

Terms of 6-12 months

Loan-to-value ratios up to 80% of current home value

Origination fees of 1.5-3%

While more expensive than traditional financing, bridge loans can provide the competitive advantage needed to secure your ideal East Meadow property in a seller's market.

Section 5: Step-by-Step Guide to Accessing East Meadow Home Buyer Services

Step 1: Complete Homebuyer Education

Before accessing most assistance programs, you'll need to complete a HUD-approved homebuyer education course. These courses, offered both online and in-person, cover:

Budgeting and credit management

Understanding mortgage products

The home buying process

Predatory lending awareness

Home maintenance responsibilities

Courses typically require 8-12 hours and cost $50-$150, though many nonprofit organizations offer them free or at reduced cost. The Long Island Housing Partnership provides excellent homebuyer education programs specifically tailored to Nassau County buyers.

Step 2: Assess Your Financial Position

Before beginning your home search, develop a clear picture of your financial readiness:

Review Your Credit: Obtain free credit reports from all three bureaus and review for errors. Most assistance programs require minimum credit scores of 620-640.

Calculate Your Debt-to-Income Ratio: Add all monthly debt payments (credit cards, car loans, student loans) and divide by your gross monthly income. Most programs require DTI below 43%.

Inventory Your Assets: Document all savings, checking, retirement, and investment accounts. You'll need funds for earnest money, inspections, appraisals, and closing costs not covered by assistance programs.

Determine Your Budget: Use online calculators to estimate comfortable payment ranges, remembering to include property taxes (significant in Nassau County), homeowners insurance, and potential HOA fees.

Step 3: Obtain Mortgage Pre-Approval

With your financial documentation prepared, connect with approved lenders who work with first-time buyer programs. Jet Direct Mortgage and other local lenders familiar with SONYMA, LIHP, and Nassau County programs can provide pre-approval letters that:

Demonstrate your seriousness to sellers

Clarify your maximum purchase price

Identify which assistance programs you qualify for

Streamline the final approval process

Pre-approval requires submitting pay stubs, tax returns, bank statements, and employment verification. The lender will pull your credit and issue a conditional approval letter valid for 60-90 days.

Step 4: Property Search and Selection

With pre-approval in hand, begin your East Meadow property search. Work with a buyer's agent who understands first-time buyer programs and can identify properties that meet program requirements.

Consider these East Meadow neighborhoods:

Northern East Meadow: Closer to Northern State Parkway, featuring larger lots and varied architectural styles.

Central East Meadow: Near Eisenhower Park and East Meadow High School, with excellent walkability and community amenities.

Southern East Meadow: More affordable options, convenient to Hempstead Turnpike shopping and services.

Your agent should help you evaluate not just the home itself but also factors affecting long-term value: school districts, property taxes, flood zones, and neighborhood trends.

Step 5: Formal Assistance Program Application

Once you've identified a property and have an accepted offer, submit formal applications for assistance programs. This process includes:

Completing detailed application forms

Providing comprehensive income and asset documentation

Submitting homebuyer education certificates

Coordinating with lenders on program requirements

Meeting program-specific deadlines

The Long Island Housing Partnership (accessible at lihp.org) provides guidance throughout this process. Nassau County's First-Time Buyer programs (information available at nassaucountyny.gov) have specific application windows and funding availability, so timing is crucial.

Step 6: Home Inspection and Due Diligence

Schedule your comprehensive home inspection immediately after offer acceptance. Use the inspection period (typically 7-14 days) to:

Review the inspection report thoroughly

Obtain estimates for any needed repairs

Negotiate repairs or price adjustments with the seller

Consider walking away if major defects are discovered

Remember that homes purchased with assistance programs may have minimum property standards that must be met. Your lender will order an appraisal that includes property condition assessment.

For homes near the Nassau-Queens border that might require maintenance attention, review our plumbing repair costs in NYC 2026 complete pricing guide to understand potential expenses.

Step 7: Final Approval and Closing

After successfully navigating inspections and appraisal, your lender will issue final loan approval. The closing process involves:

Final walkthrough (24-48 hours before closing)

Reviewing closing disclosure (received 3 days before closing)

Bringing certified funds for closing costs

Signing loan documents and deed

Receiving keys to your new East Meadow home

Your attorney (required in New York) will guide you through the closing process and review all documents to protect your interests.

SONYMA vs. FHA Loans Comparison

Feature | SONYMA Achieving the Dream | FHA Loan |

|---|---|---|

Minimum Down Payment | 3% (with assistance programs) | 3.5% |

Interest Rate | Typically 0.5-1% below market | Market rate |

Credit Score Minimum | 620 | 580 (with 3.5% down) |

Mortgage Insurance | Lower than FHA in most cases | UFMIP + annual MIP |

Income Limits | Yes (varies by county/household size) | No |

Purchase Price Limit | $456,750 (Nassau County) | $498,257 (Nassau County 2026) |

First-Time Buyer Requirement | Yes (3-year rule) | No |

Down Payment Assistance | Up to $15,000 available | Through separate programs |

Best For | Buyers qualifying for state programs with stable income | Buyers with lower credit scores or higher DTI |

Conclusion: Your Path to East Meadow Homeownership

Purchasing a home in East Meadow, NY represents a significant investment in your future and your family's quality of life. The combination of excellent schools, convenient location, abundant recreational opportunities at venues like Eisenhower Park, and strong community character makes East Meadow one of Nassau County's most desirable addresses.

Start your journey today by visiting the Long Island Housing Partnership at lihp.org, exploring Nassau County's first-time buyer resources at nassaucountyny.gov, and reviewing New York State programs at hcr.ny.gov. For more expert home buyer insights and comprehensive guidance on navigating the home buying process, continue exploring the resources available to East Meadow area buyers.

Your path to homeownership in East Meadow begins with a single step. With the right information, professional guidance, and access to the robust assistance programs available in Nassau County, that dream home near Eisenhower Park can become your reality in 2026.